36+ who buys mortgage backed securities

Call options put options. Web Mortgage REITs are a subcategory of the real estate investment trust REIT segment that focuses on real estate financing.

36 E Wharf Rd Madison Ct 06443 Realtor Com

Web For example you can purchase an option to buy a stock at a certain price without actually buying the stock upfront.

. Web Agency MBS are mortgage bonds which have underlying mortgages backed by Fannie Mae Freddie Mac and Ginnie Mae. Other examples of derivatives are. Web Equity Sales Trading.

Ad Rich options pricing data and highest quality analytics for institutional use. Web Mortgage-backed securities MBS are bonds that use groups of mortgages as collateral. Analytic and Tick Data.

Web Specifically an investment banker buys the loan for inclusion in a mortgage-backed security. Web The majority of mortgage-backed securities are offered by an entity of the US. The Government National Mortgage Association Ginnie.

Web March 21 2023 530 am ET. In constructing this instrument the banker intentionally uses newfangled. Web President Lyndon Johnson paved the way for modern-day mortgage-backed securities when he authorized the 1968 Housing and Urban Development Act which.

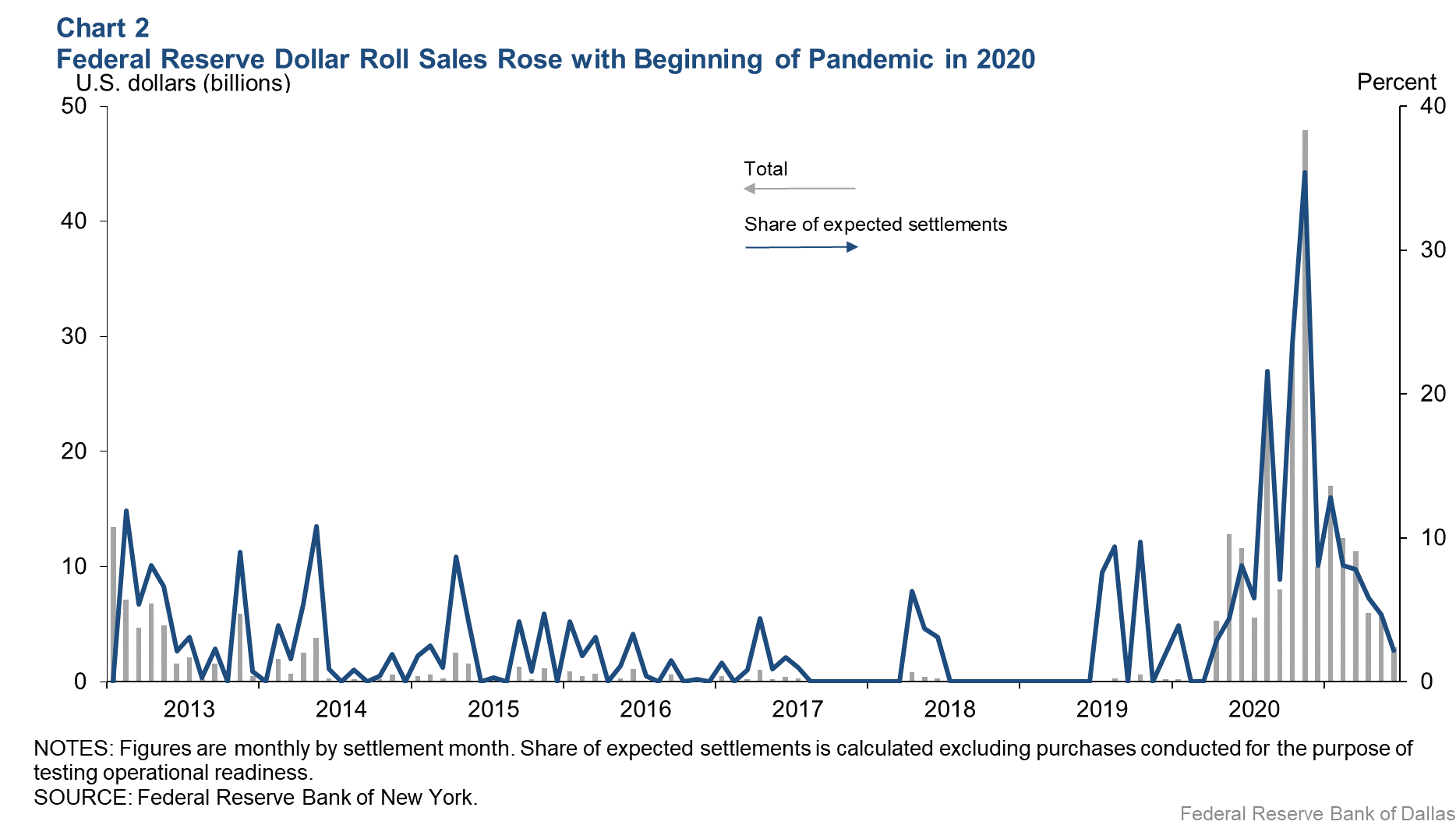

They also guarantee timely payments of principal and interest on these. The purchase of these MBS by the Fed. Its common for a lender to sell a group of home loans to free up cash and reduce.

Web Mortgage-backed securities are investment vehicles secured by mortgage loans. Ad With experience in the fixed-income markets Stout assists clients to make sound decisions. An MBS can be issued by a government agency government.

Web Ginnie Mae began providing mortgage-backed securities in an effort to bring in extra funds which were then used to purchase more home loans and expand. Learn more about choosing an Ameriprise financial advisor who is right for you. Deep Historical Options Data with complete OPRA Coverage.

Web Freddie Macand Fannie Maeboth buy large numbers of mortgages to sell to investors. Ad Receive personalized financial advice based on whats most important to you. Web Mortgage-backed securities are debt obligations purchased from banks mortgage companies credit unions and other financial institutions and then assembled.

Investors and issuers rely on our in-depth small and mid-cap fundamental and data-driven research and market knowledge as well as efficient. The entities purchase or originate. Web Which means the Fed could be financing your mortgage.

In the week ended June 23 the Federal Reserve owned 235 trillion in MBS according to the Feds H41. Stout has the experience in structured credit investments to deliver 3rd party valuations. 2 minutes Strains in the banking sector are roiling a roughly 8 trillion bond market considered almost as safe as.

Ducibella J King Of Clubs The Great Golf Marathon Of 1938 Ducibella Jim Amazon De Books

Business Succession Planning And Exit Strategies For The Closely Held

418 W 7th Ave Cheyenne Wy 82001 Mls 89145 Zillow

8341 Lyndale Ave S Apt 404 Bloomington Mn 55420 Realtor Com

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

Residential Mortgage Backed Security Wikipedia

Mortgage Backed Securities Download Scientific Diagram

Mortgage Backed Securities Decade After Financial Crisis

Texas Banking And Loan Businesses For Sale Bizbuysell

Mortgage Backed Securities Mbs Fannie Mae

16211 Moccasin Ranch Road La Grange Ca 95329 Compass

Mortgage Backed Securities Mbs

The Fed S Holdings Of Mbs Will Decline Who Will Buy Recursion Co

Homes Land Of The Smokies Vol 36 Issue 11 By Homes Land Of Tennessee Issuu

Residential Mortgage Backed Security Wikipedia

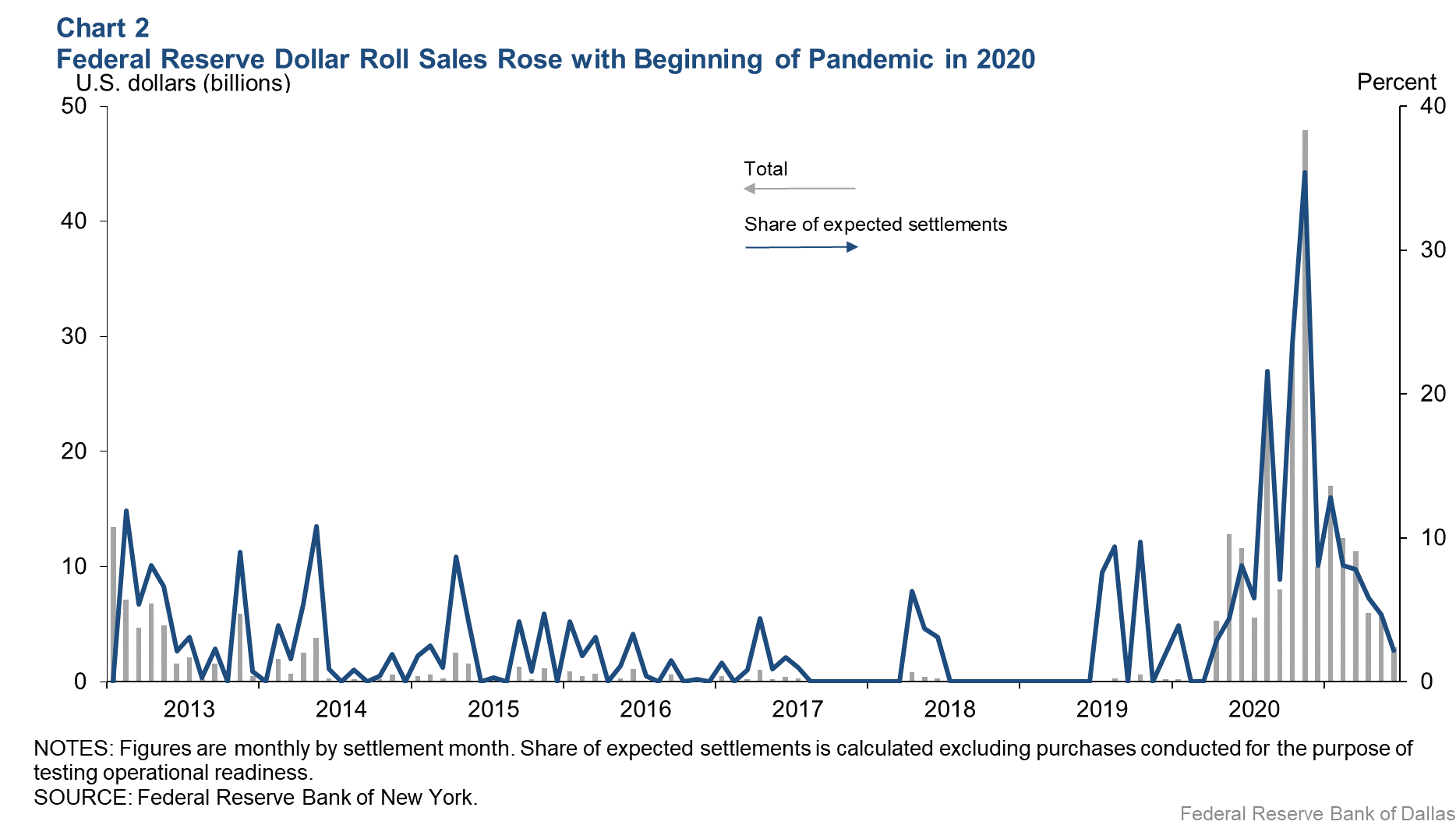

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

Real Estate Management Sales Charlottesville Va